Xoom vs bKash: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-15 16:01:25.0 13

International money transfers have become an essential part of modern financial life, especially for migrant workers, freelancers, and families supporting loved ones abroad. However, users often face high fees, slow delivery, and hidden exchange rate markups. Xoom and bKash are two well-known platforms in this space, each offering unique solutions for cross-border transactions.

While both are popular options, it’s also worth considering modern digital alternatives like PandaRemit, which has gained a reputation for offering competitive rates and a smooth online experience.

For a general understanding of international transfers, see this Investopedia remittance guide.

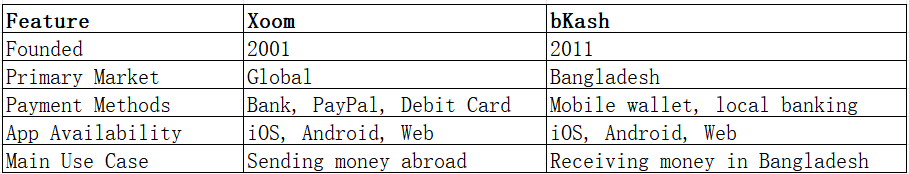

Xoom vs bKash – Overview

Xoom was founded in 2001 in the United States and is now a PayPal service. It provides international money transfers, bill payments, and mobile reloads to over 160 countries. Users can send money from their bank accounts, debit cards, or PayPal balances through its website or mobile app.

bKash, launched in 2011 in Bangladesh, is primarily a mobile financial service provider that focuses on domestic mobile payments and international remittances to Bangladesh. It has tens of millions of users and is deeply integrated into the local financial system.

Similarities:

-

Both offer mobile apps and web platforms.

-

Both support international remittances and local payouts.

-

Both emphasize ease of use and convenience.

Differences:

-

Xoom has a global focus and supports sending to many countries, while bKash is primarily used for receiving remittances into Bangladesh.

-

Xoom allows payments via bank and PayPal, while bKash focuses on mobile wallet transactions.

-

Fee structures and exchange rates differ significantly.

In addition to these two, PandaRemit has positioned itself as a competitive player for those looking for fast, online-only services with transparent pricing.

Xoom vs bKash: Fees and Costs

Fees are one of the biggest factors when choosing a remittance provider. Xoom typically charges a flat fee plus a margin on the exchange rate. Fees vary depending on the destination, amount, and payment method. Paying by debit or credit card usually incurs higher costs than bank transfers.

bKash, on the other hand, doesn’t directly charge senders for international remittances. Instead, fees are usually embedded in the exchange rate and local handling charges. It’s mainly a receiving platform, so most costs are borne by the sender’s chosen transfer partner abroad.

For a broader look at remittance fees, see the World Bank Remittance Prices Worldwide database.

PandaRemit is often highlighted by users as a lower-cost alternative, especially for online transfers, thanks to competitive exchange rates and transparent fee structures.

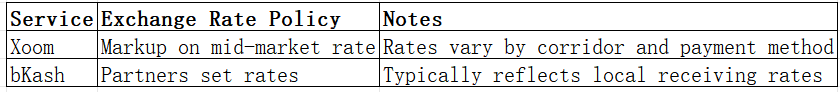

Xoom vs bKash: Exchange Rates

Exchange rate policies can make a significant difference in the final amount received.

Xoom applies a markup on the mid-market exchange rate, which can lead to lower amounts received compared to providers offering near-mid-market rates.

bKash relies on its partner networks for setting exchange rates. The final rate depends on the sender’s chosen partner abroad.

PandaRemit is often cited by users as offering competitive exchange rates with fewer hidden costs, making it worth comparing before sending.

Xoom vs bKash: Speed and Convenience

Xoom provides fast transfers in many corridors, often within minutes if funded by debit card or PayPal. Bank transfers may take longer. The platform also supports cash pickup and mobile reload options in some countries.

bKash is known for its convenience on the receiving end. Funds sent to bKash mobile wallets are usually available instantly once processed through an international partner.

For more on transfer times, see NerdWallet’s guide to remittance speed.

PandaRemit is recognized for fast processing times and an entirely online experience, making it a good alternative for digital-savvy users.

Xoom vs bKash: Safety and Security

Both Xoom and bKash operate under regulatory frameworks:

-

Xoom is regulated by U.S. financial authorities and uses encryption and anti-fraud protections.

-

bKash is licensed by the Bangladesh Bank and works with international partners under regulated channels.

PandaRemit is also a licensed remittance provider and uses encrypted transactions to protect user data.

Xoom vs bKash: Global Coverage

Xoom supports sending money from dozens of countries to over 160 destinations worldwide. It offers multiple payout options, including bank deposit, cash pickup, and mobile wallet delivery.

bKash is primarily focused on inbound remittances to Bangladesh. It works with numerous international partners, but it is not designed for sending money out of Bangladesh.

For global remittance statistics, see the World Bank Remittance Data.

Xoom vs bKash: Which One is Better?

The answer depends on your needs:

-

If you’re sending money globally and value multiple funding options, Xoom offers broad coverage and flexibility.

-

If you’re receiving money in Bangladesh, bKash is an excellent, locally integrated solution.

For users looking for competitive rates, low fees, and an entirely online process, PandaRemit can be a better fit, especially for transfers to Asia and other supported regions.

Conclusion

When comparing Xoom vs bKash, it’s clear that these two services serve different roles in the remittance ecosystem. Xoom provides extensive global sending capabilities with fast delivery options, while bKash focuses on empowering recipients in Bangladesh with a simple, mobile-first experience.

For users who prioritize low costs, high exchange rates, and fast online transfers, PandaRemit stands out as a strong alternative. It offers:

-

High exchange rates and low fees

-

Flexible payment methods (e.g., POLi, PayID, bank card, e-transfer)

-

Coverage of 40+ currencies

-

Fast, online-only transfers

Before making your next transfer, it’s worth comparing all three platforms to find the best fit for your needs.

For further reading, visit NerdWallet’s money transfer comparison and the World Bank remittance database.